When Shahirah talks about her first paycheck, she smiles like it just happened.

“I gave it to my mother. We were both so happy,” she says. “It meant something.”

What it meant went far beyond a few thousand rupees. That paycheck marked a turning point, not just for Shahirah, but for how we think about access, agency, and inclusion.

It all started with something small: a mobile phone SIM registered in her own name.

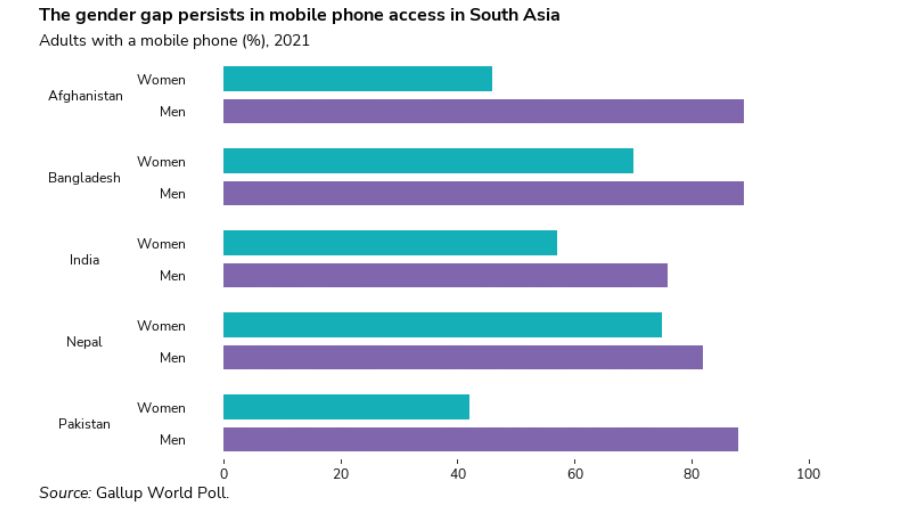

In Peshawar, Khyber Pakhtunkhwa, where Shahirah lives, cultural norms often discourage women from registering mobile SIM cards in their own names. As a result, many women lack access to a phone, a seemingly small detail with far-reaching consequences. Without a registered phone, opening a bank account becomes nearly impossible. This barrier cuts them off from even the most basic financial services, like receiving direct deposits. For countless women, phones and bank accounts are in the names of male relatives, reinforcing a cycle of dependence. Without ownership of these essential tools, financial independence remains out of reach.

That’s the gap Code for Pakistan is helping close.

When Shahirah joined Code for Pakistan's KP Women’s Civic Tech Internship — a program offering remote digital upskilling for recent IT graduates in partnership with the Khyber Pakhtunkhwa Information Technology Board (KPITB), the thought of a bank account may not have occurred to her. Between the excitement of working on civic projects and building her skillset, the question of how her stipend would be paid felt like a minor detail. But like her fellow interns, Shahirah didn’t have the basic infrastructure many systems assume people already have.

That’s where we started.

With registering SIM cards. With opening bank accounts. With providing internet devices.

With access.

With the phones in place and bank accounts set up, each intern was able to receive a stipend in her own name. Small payments, but deeply meaningful. For many, it was the first time they had earned money that was truly their own.

Some used it to cover household needs. Others saved for education. One intern paid for her mother’s treatment. While the amount wasn’t large, the agency it brought became their first step toward financial independence.

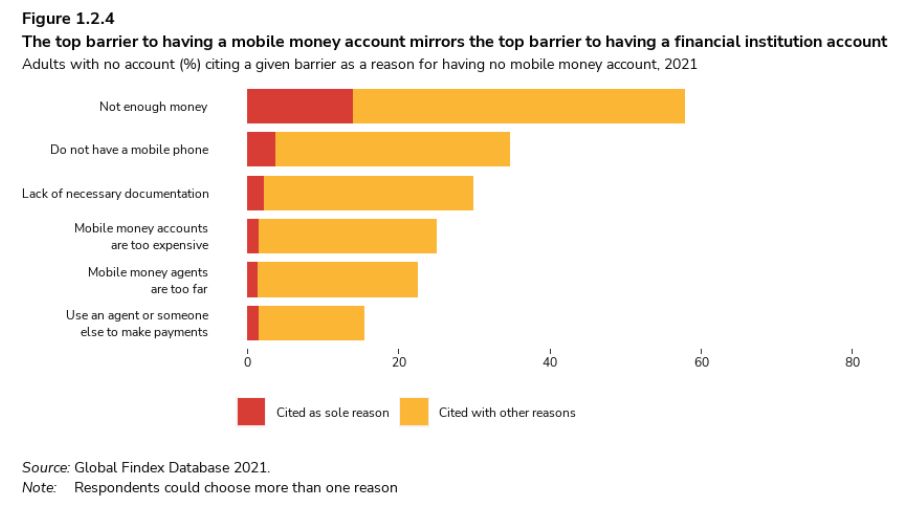

Only 13% of women in Pakistan have access to formal financial services. In conservative regions like KP, the barriers are layered — social, technical, and cultural. While initiatives like Code for Pakistan’s internship provide a practical path forward, the larger landscape remains challenging. Even these national figures are contested: the State Bank claims over 67% of adult women now own bank accounts, yet the World Bank’s Findex reports only 11.5% — a stark discrepancy that underscores the need for transparent, gender-disaggregated data.

Code for Pakistan’s approach is to work within these realities. To build access from the ground up and make digital and financial inclusion possible for women who’ve been left out.

Even when women do manage to open a bank account, many remain limited: without debit cards, without full branch access, and often still managed by male relatives. True inclusion means women can not only receive payments but also make decisions about how to use them. That’s why Code for Pakistan’s Women’s Internship Program ensures women open scheduled bank accounts in their own names, enabling broader, long-term access. While mobile wallets like JazzCash and Easypaisa fill critical gaps, they are often a pared-down version of banking—missing the tools needed for lasting financial independence.

By supporting women with practical tools like phones, bank accounts, and internet devices, the internship fills a gap for communities where women, who make up 51% of Pakistan’s population (some estimates suggest 48–49%), are essential contributors to society. They shouldn’t be left out due to technical or cultural barriers. We’re helping them step into roles as earners, contributors, and decision-makers.

Now, the next chapter has begun.

The third cycle of the KP Women’s Civic Digital Internship is underway, with 20 more young women from across the province — from Karak to Swabi — joining the program. Each brings her own story, her own ambitions, and the same potential to build a digital skillset and stand on her own feet.

To build from a place of inclusion.

Hear it in her own words.

Shahirah shares what that first stipend meant to her, and how it changed her role in her family and her sense of self.

▶️ Watch the video

Help us keep it going.

Your support can put tools, training, and direct income in the hands of women who’ve been excluded for too long. Let’s build with her.